The Liberty Block’s articles are generally focused on political opinion with a clear bias towards liberty. In addition to supporting ultimate liberty for every individual in the world, we hope to empower every individual to achieve true prosperity. In order to be prosperous, an individual must manage their finances wisely. Poor money management could lead a person into considerable debt. Such is the case for millions of Americans presently.

Throughout my entire life, I’ve never really carried any debt. The few dollars that I’ve borrowed for sandwiches or reimbursed family members for bills under their name never exceeded my bank account balance or even came close to it. Granted, I was raised by parents who provided housing and food for me and helped me with many expenses throughout my childhood. Still, I think that this simple habit I’ve developed may be useful to some people who are struggling to save or to climb out of debt.

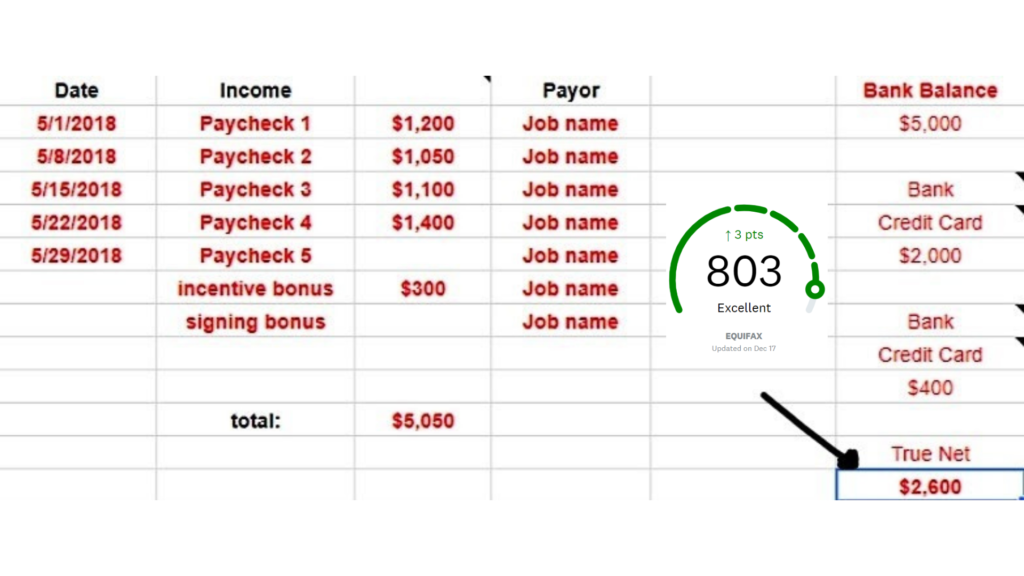

For the past few years, I’ve increasingly recorded/managed my finances using Google Sheets. I assume that this could be done with traditional spreadsheets just as well.

I began by simply recording all significant/monthly expenditures, my (net) paycheck each week, and my bank account balance. Over the years, I’ve added a multitude of additional functions and figures to the sheet.

There is one function that I think contributes more than any other to my financial success, though:

I don’t look at my bank account balance.

I look at my ‘true net’.

In the top right of my sheet is my current checking account balance. A few rows beneath it is my total credit card usage (which I set to automatically pay fully every month from my checking account). Beneath that is a box with the function that subtracts the credit card balance from the checking account balance. This is what I’ve been referring to as my ‘true net’. I look at that box to gauge my financial status. I generally don’t look at my bank balance, because it’s pretty meaningless. Call it a ‘brain hack’ or a ‘mind trick’, or whatever else you want, but this does work to convince your brain that you only have as much money as you realistically have. My true net represents the amount of money that I actually have, since my credit card will be paid in full by month’s end. This keeps me from ever going into the red.

I have a few other practices that make me feel financially comfortable. I only buy what I truly need (this is still a work in progress). I always have enough cash (actual dollar bills) to cover my total credit card usage. I think that whenever possible, everyone should have a few thousand in cash stored somewhere accessible in case of a variety of emergencies. I think that writing down every significant expenditure is also an effective way to hold yourself accountable. You may want to buy a new AR, but you know how much you’ll hate seeing that $600 in the expenditure column for the rest of the year. I still spend more than I need to and I have a long way to go before attaining perfection, but I think that if more people employed habits like these to keep their finances in order, we might not have a nation whose average household carries $5,000 of credit card debt and another $10,000 of real personal loans (not counting obligations like car payments and home mortgages). American student loan debt is massive as well. We must find a way to spend our money more appropriately if we want to remain prosperous.

Which practices do you employ to help manage your finances? Would you find this helpful?