One of the freedoms that I enjoy most is the liberty to invest in whatever I believe in. We Americans have the freedom to invest in infinite stocks, currencies, real estate, guns, ammunition, food, cars, retirement accounts, and practically anything else in existence. I have invested or considered investing in all of the above entities. Some Americans, however continue to invest in other types of plans. For this article’s sake, I will refer to those plans as the Roosevelt Investment Program. Hopefully, by the end of the article, you will see why it is so named.

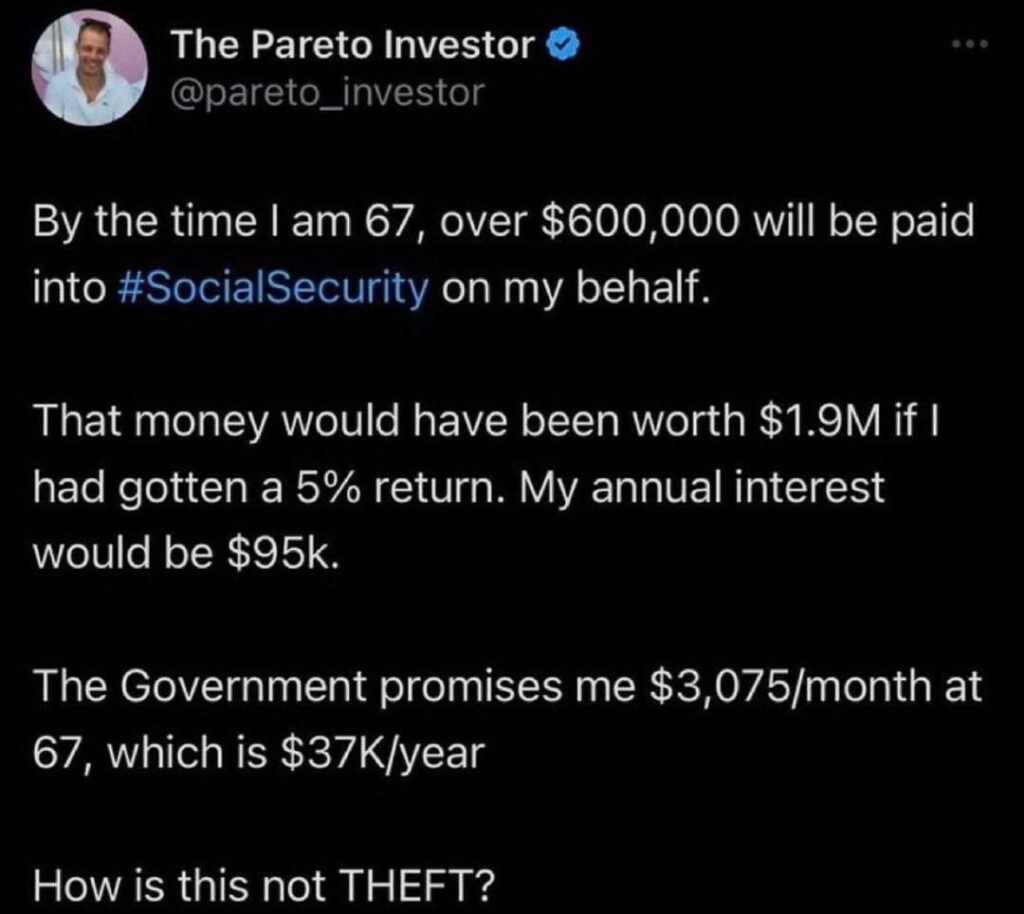

The primary component of the Roosevelt Investment Program (RIP) was created in 1935. For a reason that remains mysterious and contentious, millions of Americans began a long-term savings plan right in the middle of the great depression, at a time when money would seemingly be most scarce. This was created as and remains the primary investment plan within the RIP. The plan involved employers and employees each contributing a small percentage (around 1% of the salary) which would be saved/invested and then paid out to them in a small percentage each month once they turn 65 and retire. That figure has steadily risen throughout the years. Currently, almost every American employer pays 6.2% of each employee’s salary towards this retirement plan. Of the remaining salary, each employee pays an additional 6.2% towards this primary fund of the RIP.

In 1965, a supplement to the RIP focused specifically on securing health insurance for the elderly was created. In order to fund this second program, millions of people began to pay 1.45% of their every paycheck towards the health insurance portion of the RIP, and like the primary investment plan, every employer began to pay 1.45% of the employee’s gross pay as well. Once people retire, they begin to collect from the fund that they and their employer contributed to each week of their careers. It’s a wonderful program. Is there any downside?

The RIP goes bankrupt

Over the past few decades, the large corporation that operates the entire RIP and its subsidiaries has seemingly mismanaged the funds quite recklessly. It remains controversial whether the primary issue is a lack of people funding the programs or illegitimate use of the funds for other purposes, but the corporation has admitted that the program will not be able to continue making its payouts in 2034. This constitutes ‘insolvency’ and is generally associated with Ponzi schemes in the finance world. Additionally, the programs have come under fire due to the controversial decision to raise the age at which people could begin seeing their money returned to them – twice. Curiously, nobody has stopped paying the obligatory 15.3% of their income into the program, despite these disturbing controversies! Why not?

In addition to the Madoff-esque criminal mismanagement of other people’s money, the corporation’s board decided in 1984 that when people do receive their money back after retirement, they must give back a percentage of that money to the corporation. This would be like being taxed on your tax refund! The corporation’s actuaries also estimate that within 10 years, they will no longer have the funds to make 100% of their required payouts for the health insurance portion of the RIP either. As the reader, you have the responsibility of deciding whether these are programs you want to invest in. If you are no longer confident in these ventures, you can opt out!

The opt-out

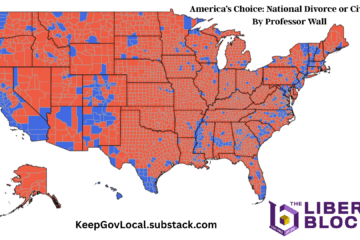

Recent years have seen an increasing number of people rejecting central planning, socialist ideology, and the once-popular Roosevelt Investment Program. As the internet, social media, and now smart phones and other devices have made seemingly infinite information extremely accessible and transferable, many Americans are quickly learning how corrupt the RIP truly is. These people face a serious hurdle if they hope to cancel their weekly contributions to the investment program: It is mandatory and enforced by the full power of the federal government. These programs are called ‘Social Security’ and ‘Medicare’. If you refuse to pay the required thousands of dollars a year towards the insolvent programs, federal police will come to your home with guns and imprison you or kill you. The only hope for ending mandatory participation in what is cynically referred to in the article as the ‘Roosevelt Investment Program’ may be removing all socialist officials from political office and replacing them with people who don’t support such tyrannical programs – our only hope may be to elect libertarians.

This article does not necessarily reflect the opinions of The Liberty Block or any of its members. We welcome all forms of serious feedback and debate.