In February of 2018, The Liberty Block published an article explaining why the payroll tax was the ultimate hidden tax. With all due respect to that author, I would beg to differ. There is a tax that is much more damaging and at least as inconspicuous as the payroll tax, and with this article, I seek to prove it.

In order to truly understand this form of taxation perpetrated by the government, it is critical to understand what currency is. Many people live their entire lives without giving much thought to the definition or backstory of currency. Simply explained, currency developed naturally as a medium of exchange in order to facilitate trade among people for products and services among people. Currency could be thought of as a receipt which denotes services rendered or value that could be exchanged for a predetermined amount of product. Without these receipts, employers would have to pay their employees with their product, which could make it difficult for the employee to trade in the marketplace. Money simplifies and facilitates trade within a society. This video explains this concept quite well. Indeed, the last 15 seconds of the video is crucial to understanding this hidden tax that was created by a group of truly sinister politicians and/or bankers in 1910 and solidified by FDR in 1933 and Nixon in 1971.

Before corrupt politicians and bankers created their joint venture in the 20th century, dollars in the US represented real gold, which the federal government was obligated to grant the ‘bearer of the bill upon demand’. In 1910, however, a then-secret meeting between bankers and politicians who were involved in ‘banking regulation’ met and created a banking cartel which would be partnered with and supported by the federal government. Three years after drawing up their plan, these authoritarians passed the Federal Reserve Act. The federal reserve was a bank that could loan non-existent money to the federal government, which the federal government could then spend. Naturally, this caused massive inflation. The author of the book ‘the creature from Jekyll Island’ explains how inflation benefits the government and big banks and hurts Americans.

In 1933, Democratic hero, President Franklin D. Roosevelt criminalized the ownership of gold and demanded that all Americans hand over their gold to the federal reserve (whose board is selected by the president of the United States). This began the authoritarian, corrupt move away from the gold standard that had backed the US dollar. Now the federal reserve – the joint venture between the US government and the most powerful bankers of the era – owned nearly all of the gold in the US, FDR could really put a dagger in the heart of American currency. In 1934, King Roosevelt declared that gold shall cost $35 per ounce. This socialist, fascist president showed the American people the simplest example of authoritarian government-caused inflation. Yet, his sycophants continued to reelect him again and again. The US government continued to empower the Federal Reserve and solidify their partnership with the banking cartel. In 1971, Republican president (and infamous crook) Richard Nixon officially moved the US dollar off of the gold standard, putting the final nails in the coffin of America’s national currency.

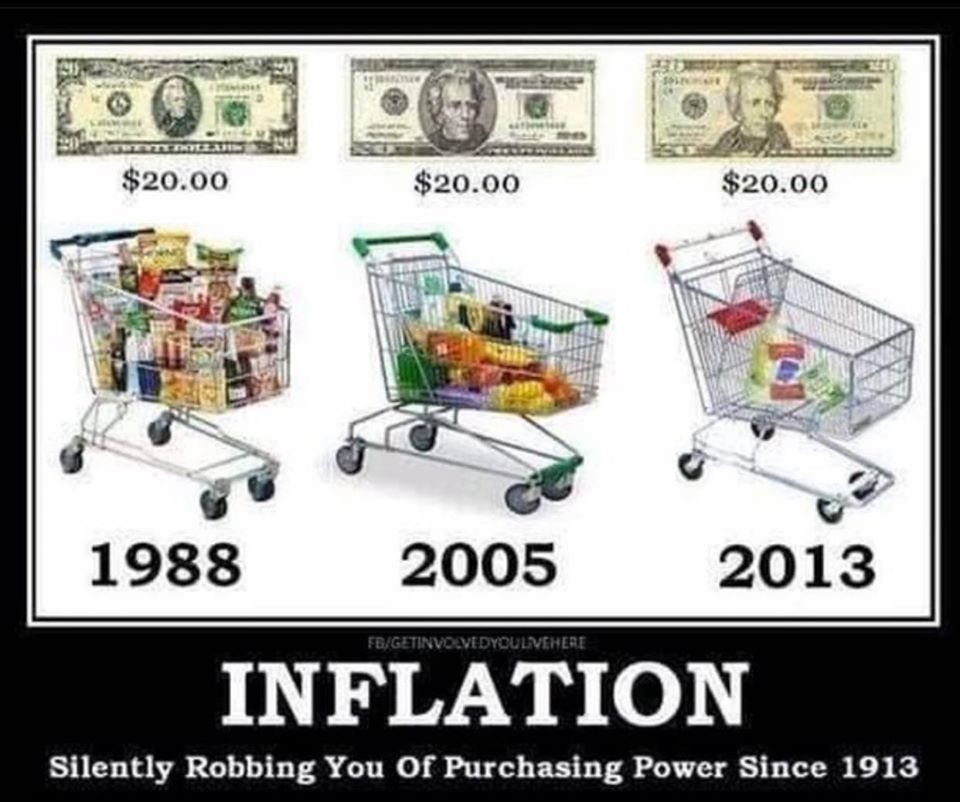

Even the US government readily admits that you would have to spend over $2,580 today to buy the same things that just $100 would buy in 1913. This translates to an inflation rate of over 2500% since the establishment of the federal reserve in 1913. If you open your wallet and look at those paper bills, you’ll notice that they say ‘federal reserve note’. If you look at bills from before the creation of the federal reserve, that phrase does not exist. Instead, you might find phrases like ‘dollars’ and ‘gold coin’ and ‘treasury note’, perhaps depending on the era.

An increasing number of Americans are realizing that federal reserve notes have decreasing value with each passing day (current inflation is around 2% per year).

So, what should we do with our fiat currency which is perpetually plummeting in value?

1) Invest in commodities that are likely to hold their value: Commodities with real uses are always a great option. Some examples of items that hold their value and/or have practical uses are tools, firearms, ammunition, imperishable food, water purifying systems, property, vehicles, computers, clothing, etc.

2) Invest in yourself: Your skills and experience could never be taken away by the government (unless they incarcerate or kill you – unlikely, though not entirely which is not implausible). As long as you have the ability to build houses, treat the sick and the injured, write books, fix cars, or do anything else that people might value, you will be able to earn a living.

3) Consider using alternative currencies: An increasing number of people in the US and around the world are transitioning to digital and physical currencies that are more likely to retain their value than the fake federal reserve notes currently issued by the US government. Many people are excited about crypto-currencies because many of them have a finite amount of currency (technically making inflation by dilution impossible) and because they are anonymous, unlike digital transactions involving US dollars/federal reserve notes.