Yesterday, I saw an unbelievable article published by CNBC, a leading leftist propaganda publication. The headline alone made me wonder whether its author was mentally impaired or simply a socialist propagandist. The article proved to be one of the most pathetic exercises in psychosis that I’ve ever had the misfortune of coming across in my life.

The headline read: “Inflation’s Silver Lining: Higher Salaries“, and the article expanded on the childish logic that the title was based on.

Immediately, thousands of Twitter users who have more than a handful of brain cells called out the ridiculous propaganda for what it was. Predictably, individuals who understood the basics of economics explained that rising wages are not a net benefit if all the costs for products, services, and housing are increasing by at least the same percentage. These commenters explained that rising wages secondary to inflation has a net neutral effect on effective net income. But they all seemed to misunderstand just how harmful inflation is to net wages.

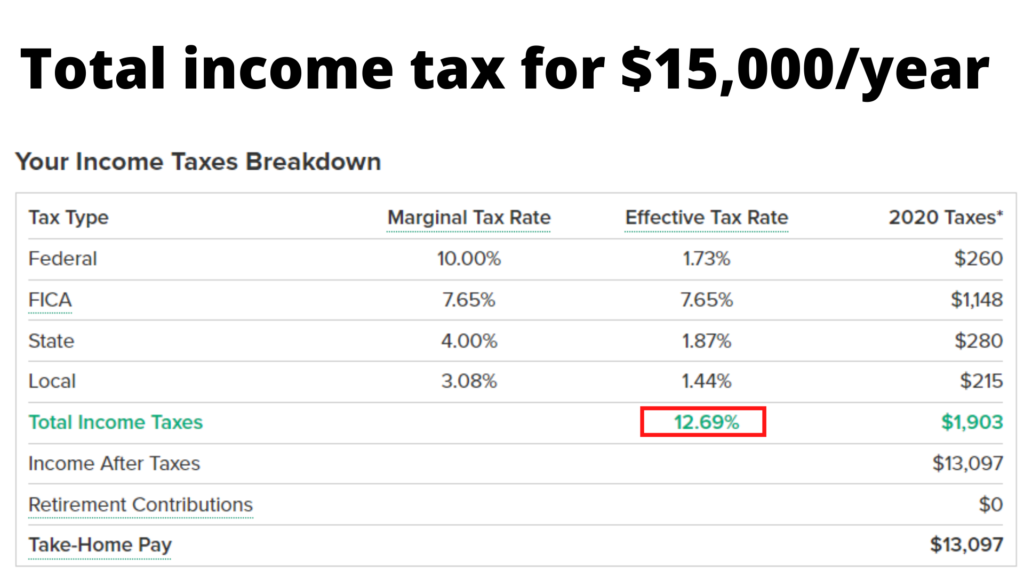

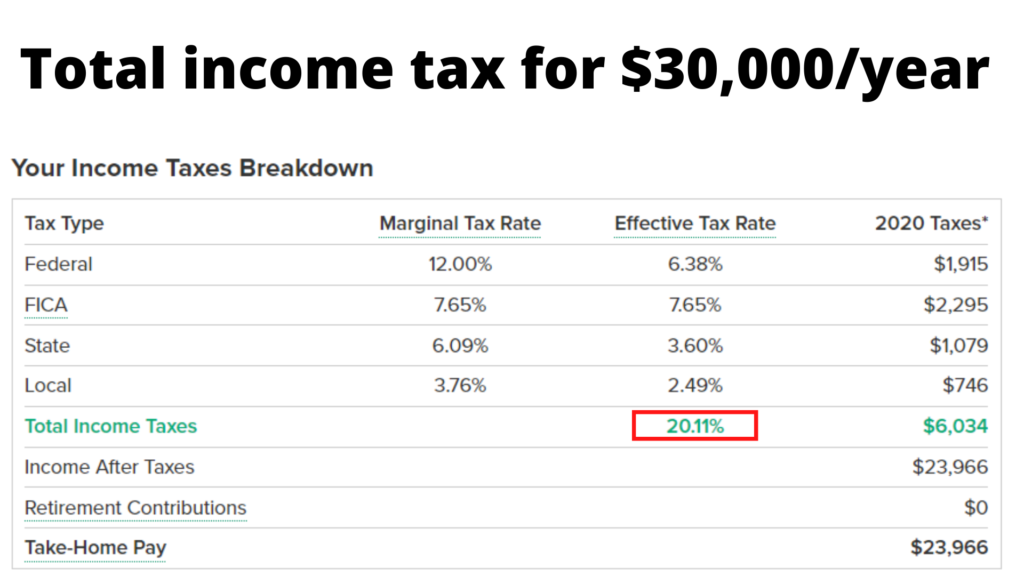

For example: Sally earns $15,000 each year, and pays $12,000 for all of her living expenses. Over the next few years, the 100% inflation causes everything to double in dollar amounts. Her living expenses have doubled to $24,000 each year. Her salary has doubled to $30,000 each year. Her disposable income has doubled from $3,000 to $6,000 per year, but it only buys the same amount of stuff as it always has. So, she breaks even, right?

Not quite.

One major thing does change when wages increase: tax rates.

Rising wages don’t just mean that the government takes more income because it’s still taking the same percentage of your income. As people earn more money, the nasty politicians actually take a higher percentage of the money you earned. Sally’s effective tax burden increased not just in dollars but in a real, meaningful way: percentage. Her rate went from under 13% to over 20% because of inflation.

The same bracket brilliance occurs when politicians increase workers’ gross earnings via minimum wage laws. That’s why socialists love such laws. They make them appear more generous while really allowing them to steal higher percentages of earners’ incomes.

This brilliant trick applies to other taxes as well. Another large example is the sale of homes. As people sell their homes for a higher price than they originally bought it for, they technically earn a profit. The IRS does not tax that profit unless it’s more than 250k (500k for joint filers). They last updated this number for inflation in 1997, when 250k was a massive amount of money. Today, a substantial percentage of home owners live in houses that have increased in 250k in nominal dollars since they first purchased it. Thanks to inflation, more people are now subject to this tax, which may make it impossible for them to move out of their homes.

This article does not necessarily reflect the opinions of The Liberty Block or any of its members. We welcome all forms of serious feedback and debate.