For years, leftist tyrants (which describes nearly every person in DC) have used many deceptive techniques to advance their agenda. Their ultimate goal is to increase taxes, regulations, control, and abuse of people, while empowering themselves and their cronies. The easiest way to accomplish this is not through brute force; tyrants prefer to convince people to vote for – or even to beg for – increases in taxes, regulations, crimes, and governmental power. Often, this deception involves purposely conflating two similar terms which most laypeople cannot distinguish.

On May 1st, Elizabeth Warren, a communist senator representing the Marxist state of Massachusetts published the following statement:

“The bottom 99 percent paid 7.2% of their total wealth in taxes last year. But the top one-tenth of one percent—the top millionaires and billionaires—paid 3.2%. Less than half as much. That’s not right. And that’s one reason why it’s time for a #WealthTax in America.”

At first glance, nearly everyone misunderstands what the evil tyrant is saying. Naturally, when discussing annual tax rates of rich people, nearly everyone assumes that the tax being discussed is the federal income tax. Currently, the federal income tax is divided into seven brackets, so that those who earn more pay more money – and a higher percentage of their annual income – than those who earn less. This is disgusting, unfair, socialist, and it literally penalizes hard work and productivity. But it’s not enough to sociopathic criminals who thrive on violating the natural rights of humans. Kleptomaniacs like Warren, Sanders, and nearly everyone else in DC want to create an entirely new tax.

The tweet does not refer to the income tax. In addition to the income tax, the ‘Marxist Tax Act’ imposes a 2% tax on the net worth of wealthy people. So, if a person’s total net worth is 10 times their annual income, they would essentially pay an extra 20% income tax. (so, their effective federal income tax burden might go from 30% to 50%) Add all of the other federal taxes, state taxes, and local taxes, and a person might have an effective total tax burden of 90%, which leftists would love.

Currently, the bill only seems to apply to those with a net worth of over $50 million, but amendments in the Senate or House could easily bring that number down to 10 million, one million, or even $400,000. Keep in mind that Biden spent his entire presidential campaign promising that nobody earning less than $400,000 per year will see a tax increase – and then he broke that promise right after being sworn in.

Make no mistake; these evil communists believe that they are entitled to 100% of your property. They just ‘allow’ you to keep some of it each year. But they can end that generosity at any time.

Why should you care if the mega-wealthy people are taxed?

There are numerous reasons:

- Taxation is theft, and theft is wrong, regardless of the amount, the reason, the perpetrator, or the victim.

- As I mentioned, this bill could easily be amended to also include people with your net worth.

- All taxes roll downhill. If Bezos must pay billions of dollars per year in extra taxes, he must also increase the prices of his goods and services to compensate for the increase in taxes. (remember my lessons about revenue and expenses?). If you don’t want to see your Prime subscription – and all other goods and services you enjoy – increase by billions of dollars, you should not support a wealth tax.

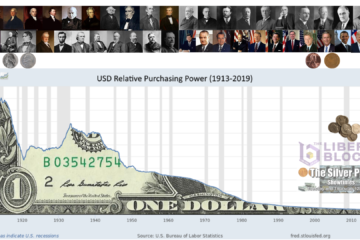

- Inflation could also bridge the gap between the current threshold for the wealth tax and your net worth. As the policy naturally expands to include more Americans, inflation will technically increase your total net worth. As the dollar loses value, your house, investments, and other assets will technically be worth more dollars. In 10 years, it’s likely that 50 million Americans could be on the hook for paying this tax.

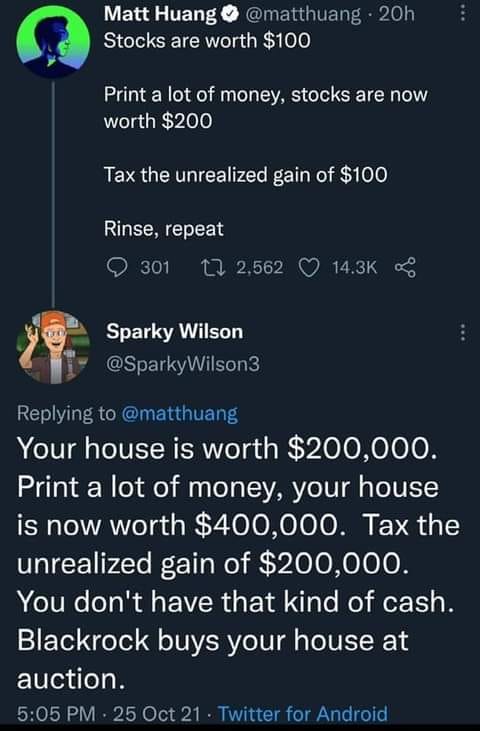

In regards to the inevitable tax on unrealized capital gains:

Realizing that each day, more Americans exchange their dollars for cryptocurrencies, the politicians are panicking. The less demand for something, the less it’s worth. Inflation of the money supply coupled with plummeting demand for USD is going to cause it to die far too quickly. So, they must destroy cryptocurrencies. By taxing unrealized capital gains, the government could essentially hedge against crypto destroying the dollar.

Those who are buying crypto with their USD are not necessarily investing. That is to say that they do not plan to sell their investment back into USD and then pocket the profits. That would be a traditional capital gain. Once the investment increases in value and is sold for USD, it becomes a ‘realized capital gain’ and is generally subject to taxation just like ordinary income. However, those who buy crypto plan to hold it and eventually use it as currency – as it was intended to be used. So, they are able to essentially invest in something that increases in value, but they are never taxed on it, because it is never sold, per se. So, the brilliant politicians came up with the plan to tax unrealized capital gains. This would force those who buy crypto to pay taxes whenever their crypto increases in value. Genius!

This article does not necessarily reflect the opinions of The Liberty Block or any of its members. We welcome all forms of serious feedback and debate.