Nearly every government eventually becomes greedy and seeks to steal more from its people than it could via simple taxation. Tyrants in the federal government always wanted to control the money that the people used. Alexander Hamilton wanted the President to rule over the Americans for life with massive powers, and he wanted the central government to be quite authoritarian. He also wanted a central bank so that the federal government could control the money. Ultimately, he was made Treasury Secretary by George Washington in 1789.

The word ‘Dollar’ had a very specific definition: 371 grains of silver. At various times, the federal government coined money from both gold and silver. When paper bills were first created, the one-dollar bill actually represented one dollar – meaning that it could be redeemed for 371 grains of silver at the US Treasury at any time. Today, that same one-dollar bill does not mention the word silver nor does it say that it’s redeemable for anything of real value. It is backed by nothing other than the faith in DC politicians.

From the moment the colonists seceded from Britain in 1776, the union of states enjoyed tremendous prosperity and economic growth without a central bank. In 1791, Hamilton convinced Congress and President George Washington to create the first central bank. It was responsible for only 20% of the currency supply; state banks accounted for the rest. Those who supported liberty and limited government opposed the government owning a central bank. Thomas Jefferson saw it as an engine for speculation, financial manipulation, and corruption. In 1811 its twenty-year charter expired and it was not renewed by Congress. Absent the federally chartered bank, the next several years witnessed a proliferation of federally issued Treasury Notes to create credit as the government struggled to finance the War of 1812.

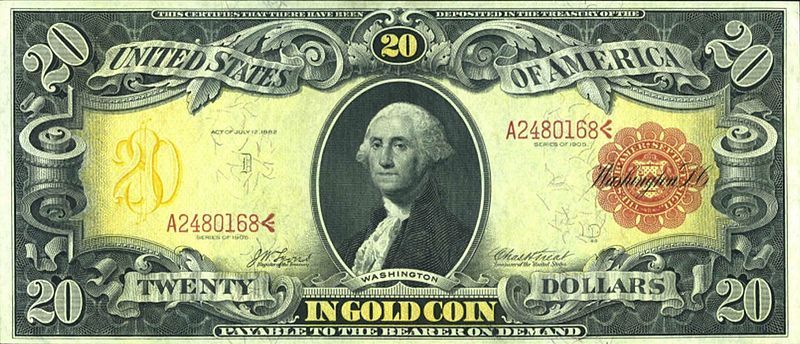

In 1816, President Madison and Congress created the 2nd Central bank, whose charter expired 20 years later. President Andrew Jackson attempted to counteract this by executive order requiring all federal land payments to be made in gold or silver, in accordance with The Constitution of the United States, which only gives Congress the power to “coin” money (make money out of silver or gold), not emit bills of credit (such as federal reserve notes/modern dollars and loans known as ‘bonds’).

As per the Constitution and all common sense known to humanity, only gold and silver were considered money. Sometimes, people accepted paper notes that represented the silver or gold, but the real precious metals were the only forms of actual money. But under this system, creating new money was extremely slow. Silver and gold take time to be discovered, mined, refined, and then coined. DC politicians hated being constrained by the naturally slow expansion of the volume of gold and silver. They wanted to spend billions more each year. This meant that they had to find a way to create paper money that represented nothing of value, and they had to cunningly sell it to the people without inciting a revolution.

Congress suspended the gold standard in 1861 early in the Civil War and began issuing paper currency (greenbacks). The federally issued greenbacks were gradually supposed to be eliminated in favor of national bank notes after the Specie Payment Resumption Act of 1875 was passed. However, the elimination of the greenbacks was suspended in 1878 and the notes remained in circulation. Federal debt throughout the period continued to be paid in gold. In 1879, the United States had returned to the gold standard, and all currency could be redeemed in gold.

In 1862, Lincoln issued $150 million in paper notes to finance the war against the southern states who had declared independence from the DC politicians. This was the first fiat currency in the united states. The law was severely unconstitutional. The value of the notes plummeted. In 1871, the Supreme Court ruled that paper notes that weren’t redeemable for real money were constitutional despite clearly violating the constitution. The greenbacks printed by Lincoln during the war had lost nearly all of their value, because they were based on nothing other than the faith in DC, which was barely existent. In 1875, congress passed a law that required the Treasury to allow citizens to redeem the greenbacks for real money (silver and gold). This restored confidence in the notes, because they once again represented real money.

In 1863, the DC politicians passed the National Banking Act, largely to finance the war against the southern states. The law also expanded the federal government in many ways, including creating a system of national banks, creating the office of the ‘Comptroller of the Currency’, and it allowed the DC politicians to go into debt by selling ‘Treasuries’ (bonds). The DC politicians then placed a 10% tax on state banks’ bills, which drove them out of business, leaving only the federal government’s national banks standing. This caused terrible liquidity issues and bank runs, leading to multiple depressions, the worst of which was the ‘panic of 1907’.

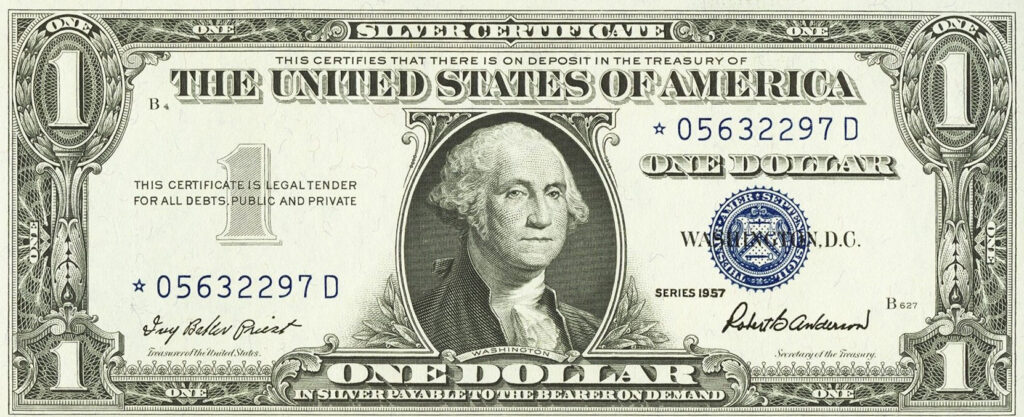

In 1878, the federal government began printing silver certificates. Each of these one-dollar notes was redeemable for one real dollar – that is, 371 grains of silver.

In 1913, the biggest private banks collaborated with DC politicians to form a new type of central bank. This brilliant idea would create an institution that is not accountable to the voters or to private market forces. After some obstacles, they passed the bill through Congress and Woodrow Wilson signed it into law. The Federal Reserve admits that its goal is inflation of 2% per year.

In 1914, one dollar Federal Reserve Notes were able to be redeemed at the US Treasury for one dollar in real money.

The next major event took place in 1933 when FDR confiscated all gold coin, bullion, and certificates from citizens and made it a crime to own gold. It became a major crime to possess more than 5 ounces of gold. The Dictator gave Americans $20 per ounce of gold.

Gold would remain illegal to own gold until 1974. The federal government then declared that the price of gold was $35/ounce, up from $20. This relatively high price discouraged (naïve) citizens from buying gold, allowing DC politicians to horde the precious metal more easily. The high amount of FRNs each gold ounce was worth also increased the flow of gold from foreign governments to the federal government because other countries still valued the dollars more than gold when they could get $35 for each ounce.

Still, in 1934, FRNs could be redeemed for silver.

By 1944, the DC Empire held more than 75% of the world’s gold. This made it very powerful. At this time, nearly every major country agreed at the UN meeting in Bretton Woods, New Hampshire to a new financial system: Instead of using gold as the world’s primary currency, they would all tie their currencies to the US Dollar. “But don’t worry, because the dollar will be tied to gold at $35 per ounce!”, the US assured the other nations. The DC politicians began printing much more paper money than they could back up with gold. And other countries began to notice.

In 1955, the DC politicians printed massive amounts of paper money to fund the $168 billion ($1.7 trillion in today’s money) cost of the Vietnam war. This caused horrific inflation in the money supply and prices.

In 1963, the federal government removed the words “shall be paid to the bearer on demand” from FRNs. In 1968, the DC politicians stopped allowing people to redeem FRNs for silver.

“Governments cannot create gold or silver out of thin air…but they can create dollars out of thin air!”

In 1965, the government removed the silver from dimes and quarters. They always contained 90% silver. Until the crooks in DC took all the silver out of them, determined not to let we the filthy peasants even touch any real money.

In August 1971, France’s government collected its remaining gold from the federal government, as did the governments of nearly every other country. They knew that they wanted to hold more gold and less dollars/FRNs, especially before the American inflation went through the roof.

Later that month, President Nixon declared that the federal government would stop redeeming FRNs for gold, ending the Bretton Woods agreement. Immediately, the value of the dollar plummeted, because other nations and even Americans no longer valued it at its supposed price of 1/35th of an ounce of gold, because it was no longer redeemable for gold. This caused inflation of the dollar in the 1970s to be in the double digits per year. While Nixon was a corrupt tyrant for severing the link between gold and the dollar, there was some truth to his concern that other countries were converting their dollars to gold, which was their right. Eventually, the reckless printing of dollars by DC politicians caused too many dollars to be in circulation. And once too many bearers of those dollars exercised their right to redeem them for gold at the US Treasury, the federal government had no choice but to stop allowing dollars to be redeemed for gold, because they barely had any physical gold left in their vaults.

The result? Items that cost $1 in 1971 now cost $7.

By working hand in hand with the newly established ‘Federal Reserve’, DC politicians were able to create paper money that was more detached from real money (gold and silver) than ever before.

In 1982, the federal government removed nearly all of the copper from pennies, which previously contained 95% of the useful metal. Today, pennies contain only 2.5% copper and are mostly made of zinc.

In 2020, the federal government quietly lowered the reserve requirement for banks to zero, which essentially meant that they could claim to have infinite FRNs in their customers’ accounts without having any FRNs in their actual banks.

In 2021, the federal government announced that due to inflation, they will cease production of the penny in 2023. Producing each penny costs over two cents, meaning that they literally lose money when they mint the one-cent coins!

By 2022, the federal government spent over 10 cents to produce each nickel. For decades, the 5-cent coins have been made of 75% copper and 25% nickel. Both metals have steadily increased in value over time.

Throughout corona-fascism, the DC politicians created 25% of all dollars in existence. The trillions of dollars created each year by DC further dilute the value of each dollar you thought was securely in your possession. Inflation allows politicians to tax you without ever touching you or your money. Those that use their money suffer when they print more of it. Those that own gold, silver, crypto, or anything of value are protected from inflation.

Increasingly, Americans are discovering that they need to acquire sound money before corrupt politicians use their Ponzi Scheme to rob them of all their worth.

Why do politicians want to devalue their own currency?

The federal government loves to spend. They spend money on wars, which require paying soldiers and obtaining billions of dollars’ worth of weapons, technology, and other materials. They also spend billions they don’t have on welfare and other forms of bribery in order to win the votes of undecided naive voters. But they don’t want to raise taxes by billions of dollars in order to afford the massive spending increases, because that is a guaranteed way to lose the next election. So they pretend to ‘borrow’ the money from the federal reserve. In 2019, the DC politicians spent around 5 trillion and took in around 3.5 trillion from taxation. The difference is called the ‘deficit’, and it plunges DC further into debt, which is now over 30 trillion dollars. Of course, they could never pay back this debt, but they do need to at least pay the interest on the debt each month. DC politicians are not smart, but they do know that 30 trillion is a very big number. But they also know that as each dollar depreciates in value, debt denominated in dollars also decreases in value. If I owe you $100 today and I pay back that same $100 in 70 years, it’ll be much easier because $100 will be the value of a few peanuts in seven decades. Thus, inflation benefits politicians. But it kills the people in the middle class who have their savings denominated in dollars.

Being a responsible American worker, Mr. John Smith worked hard for 30 years to save a million dollars for retirement. Now that he’s here, he finds that $1,000,000 is barely enough to sustain him and his wife for 4 years, not the 20 years they will live beyond retirement. John’s son is paid $65,000 per year, which is more than the average worker. His pay raises of 2% per year are nothing compared to the real inflation, which is around 15% per year. He now finds that his salary is not enough for him to live, and he is forced to find a second job or take out a loan to stay afloat.

What about the wealthy?

Those with lots of money are well-connected to politicians, or at least well-informed about true money. So, they do not hold onto dollars, because they are perpetually losing value. They make sure that their net worth is spread across various asset classes that are not affected by (or benefit from) inflation, such as real estate, stocks, ETFs, businesses, and gold and silver.

What about the poor?

They don’t have large amounts of savings, so the devaluation of the dollar does not hurt them much. In fact, the more debt they have, the better. If Joe Poor took out a $35,000 loan 20 years ago thinking it was a lot of money (because it was), he worries about it less each day. In a few more years, $35,000 will be peanuts.

Here are some steps you can take to protect yourself from inflation today:

Look at the change in your wallet. All coins except for pennies have a silver color, right? Remember that they were made of 90% silver until the government began cheating us in 1965 when they took all of the silver out of quarters and dimes. If you find any of these ‘constitutional silver’ coins dated 1964 or earlier, save them. It’s worth its weight in silver. Remember that in 1982, politicians became too greedy to put copper into pennies. Save all the pennies dated 1981 or earlier. They are worth at least triple their face value, and they will only increase in value as copper becomes more scarce.

Next, visit your local coin shop and familiarize yourself with the staff and the inventory. Buy a one-ounce silver round of any type. The Local Silver Mint is a sponsor of The Liberty Block and offers a large variety of silver, gold, and other products for the best prices that I have ever seen.

Visit online precious metals companies and find the best prices for gold and silver. Buy what you can afford, and make that a regular habit.

If you find that you want to spend your real money, look into the goldback. As opposed to the greenback, this bill is backed by real money. In fact, it contains real gold inside of it. The bills range from one-thousandth of an ounce to one-twentieth of an ounce of gold. As inflation increases more rapidly, more Americans are beginning to use goldbacks instead of FRNs.

You can also invest in gold and silver through investment vehicles. If you open your Robinhood account and search for gold and silver, you will find stocks of mining companies (which are risky) and ETFs that represent gold and silver. There are other creative ways to invest in gold and silver via the stock market, as well.

Since the creation of the Federal Reserve in 1913, the dollar has lost nearly 100% of its purchasing power. Now you understand how inflation is the ultimate and most hidden tax.

However you decide to do it, start exchanging your Fraudulent Reserve Notes for real money before it’s too late.

Even in the 1780s, politicians in the newly independent colonies used paper money to screw people over while enriching themselves via money manipulation and imposing taxes that were higher than those under Britain, as this video explains:

This article does not necessarily reflect the opinions of The Liberty Block or any of its members. We welcome all forms of serious feedback and debate.