By Aaron Day for The Liberty Block

Why you should vote “No” on SB193 (Medicaid Expansion for Education) and join the effort to permanently reduce the state’s involvement in Education.

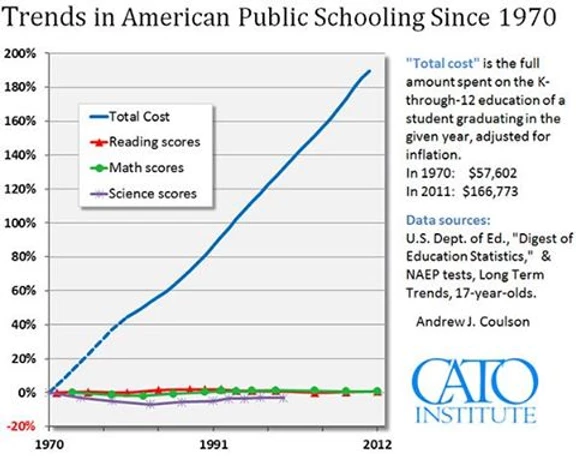

Maximizing educational opportunities for our children is one of the most impactful mechanisms for building a prosperous future for everyone. Government’s intrusive role in education at all levels remains one of the biggest threats to our liberty and the data shows has been a sinkhole for tax dollars while producing flat to declining results.

School choice has been an important issue for me. I send my 7 year-old twins to private school and ran for school board in Bedford on a platform of reducing costs and increasing transparency and accountability.

I was initially intrigued by SB 193, as it was a program that would allow any parent to direct a portion of their state adequacy funds to a school of their choice without any impositions on the private school or homeschool markets.

As the bill went through the amendment process, it transformed into welfare program that will likely increase overall government spending. In essence, it is Medicaid Expansion for Education:

● It’s a welfare benefit: The program will only be available to people at 185% of the federal poverty level or below (~$45k for a family of 4).

● It won’t have a significant impact: A limited number of spaces will be available per school district.

● It won’t save money: The state will provide financial support to the local schools for losing the state adequacy money.

● It will add bureaucracy: There are initial reporting requirements for the program that will become more burdensome over time.

Proponents of this amended bill claim that you can’t predict what future legislatures will do, and that making negative assumptions about how the program will work is fear-mongering. They maintain that this is a “step in the right direction”.

However, almost all school choice advocates agree that the real long term goal is to get the state out of local government altogether, and that the proper approach for this is via a Constitutional Amendment. This should be our long term focus.

In the short term, we should focus on reducing the overall level of taxation, not join in an epic battle over who will win at the welfare benefit trough. This bill is the wrong fight at the wrong time, and we musn’t let fatigue and the simple desire to “get something done” interfere with doing the right thing for the long term.

It is true that you can’t predict what a future legislature will do, which is precisely why you should never give the state expanded power. Our elections are not done by lottery, and you can make reasonable predictions on the range of likely outcomes based on knowledge of the actual circumstances.

Given the degree to which this bill was degraded under the most auspicious of circumstances (complete Republican majorities in all branches of government), this amended bill is likely the near-term high watermark for school choice. I have been

involved in candidate recruitment for the past few elections cycles, and I can tell you This:

● Many of our strongest liberty Reps and Senators are not planning to run again.

● To date many of those leaving do not have pro-liberty replacements.

● Since the 2016 election, the Republicans lost most of the special elections (even in the most Republican of districts).

● Relative to the Democrat Party, the NHGOP is virtually broke and has no real GOTV apparatus.

● The anti-Trump sentiment on the left has brought in a disproportionate share of resources for the Dems.

● This legislative session has been an abject failure for fiscal conservatism.

The budget increased more under Sununu than under Hassan, there were major defeats regarding Right-to-Work, expanded Medicaid is likely to get its longest extension yet, and structural problems with pensions have gone unaddressed.

Republican-designed Mediscam has created a $36 million budget hole and continues to mask 27 years of fiscal irresponsibility. Our children will get the tab.

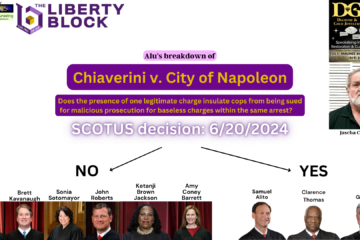

As amended, SB 193 is structurally very similar to Medicaid Expansion and must be rejected for the same reasons.

The New Hampshire version of Medicaid expansion redistributes existing federal money to low-income people for the purpose of buying private health insurance.

Amended SB 193 redistributes property tax money to low-income people for the purpose of buying private school services.

Any optimism about the future direction of School Choice in NH needs to be tempered by an examination of what has happened with Medicaid and Medicaid Expansion in New Hampshire.

It is important to note that many of the same politicians that are responsible for the destruction of healthcare in this state are still in Republican-leadership today and are supportive of amended SB 193. We need to be honest about what is likely to happen, not base our desires on hopes and wishes that are not backed up reality.

This is what has happened to Medicaid (driven by the Republicans) over the past 27 years. I have included links to references that support each point.

How NH politicians destroyed healthcare

Step 1: In order to help a Republican Governor get elected elected to the US Senate, a loophole in a federal Medicaid matching program (Mediscam) was exploited to cover our fiscal irresponsibility at the state level by borrowing billions from our children and grandchildren (instead of cutting spending or adding an income/sales tax).

Step 2: To further cover-up our financial mismanagement, we shortchanged our non-profit hospitals out of proceeds from the Mediscam creating a $36 million budget shortfall for uncompensated care for the past year alone!

Step 3: Only hospitals that accept Medicaid patients are eligible for this financing scheme. To protect this funding mechanism and protect our poor performing non-profit hospital system, the state has used the Certificate of Need to keep out new and innovative healthcare delivery options for the citizens of New Hampshire (e.g. Cancer Treatment Centers of America)

Step 4: Seeing an opportunity to further expand Medicaid, Republican leadership designed a mechanism to extract additional Federal funds (to be repaid by future generations) and then funneled that money to private insurers. The architect of this program was a consultant who also architected the Medicare Part D Prescription Drug Program at the federal level. He was found guilty of lying to Congress about the cost implications of that program.

Step 5: To pay for the part of the expansion not reimbursed by the federal government, the state decided to place an additional tax on the hospitals that are already being shortchanged and add a tax to the private insurers as well (passed on as higher premiums in the private market).

Step 6: Health and Human Services denied this new tax and has threatened to cut funding to the entire program by the end of 2018 unless a new solution is found.

Step 7: To make-up for the illegal tax on hospitals and insurers, the state has proposed a sales tax on our state monopoly-controlled liquor stores, and are using the urgency of the opioid crisis as justification for this approach.

Step 8: Alcoholism is a bigger problem in New Hampshire than the opioid crisis.

Given the similarity of approach and players involved, I predict you will see one or more of the following unintended consequences if amended SB 193 passes:

1) Overall spending on education will increase.

2) Burdensome regulations will be placed on private schools regarding testing and eligibility for the program.

3) There will be a push to exempt religious institutions from this funding.

4) To make up for the loss of local revenue, a special tax will be proposed on private schools (similar to the Medicaid Enhancement Tax on hospitals).

5) Local school districts will not respond to losing students by cutting costs, but will raise taxes and spending (this is already what is happening in school districts that face declining enrollment).

6) In order to protect the optics of this as “school choice win”, proponents will fight not to reduce the overall tax burden but accept this as the new norm. Horse trading with the left regarding pet welfare programs will become the standard operating procedure, and people will rationalize this approach as being “realpolitik”.

7) Tuition will increase at private schools and taxpayers who currently pay for public schools will now be subsidizing low-income students to attend private schools while simultaneously paying for higher private tuition.

8) Most of the school choice supporters will be stuck protecting this program and will not focus efforts on reducing local school costs, improve accountability, or work on a more ambitious Constitutional Amendment.

We can do better.

We are bringing back Stark360 with a long-term focus on reducing the absolute size of government at the local and state levels. We are building a decentralized network of activists starting with precinct leads across the state. We are implementing a reward and measurement system based on actual measured reductions in the size of government.

We are skipping the 2018 election to focus our efforts on the 2019 local elections. Our emphasis will be on candidates and ballot initiatives that will reduce the size of local school budgets. We have already developed GOTV tools for prior work on statewide elections. We will build on and refine this platform every year for local, state, federal, and special elections.

One of our key policy initiatives over the next 5+ years is to leverage our local infrastructure to recruit candidates at the state level and position ourselves to be able to successfully pass a Constitutional Amendment removing the state from local education.

Passing amended SB 193 will divert school choice resources to an approach that will increase the overall size of government and threaten to destroy the private school market in the same way the government has destroyed the free market in healthcare.

Amended SB193 is not pro-liberty and will hinder any real progress towards getting the state out of education. Vote NO.